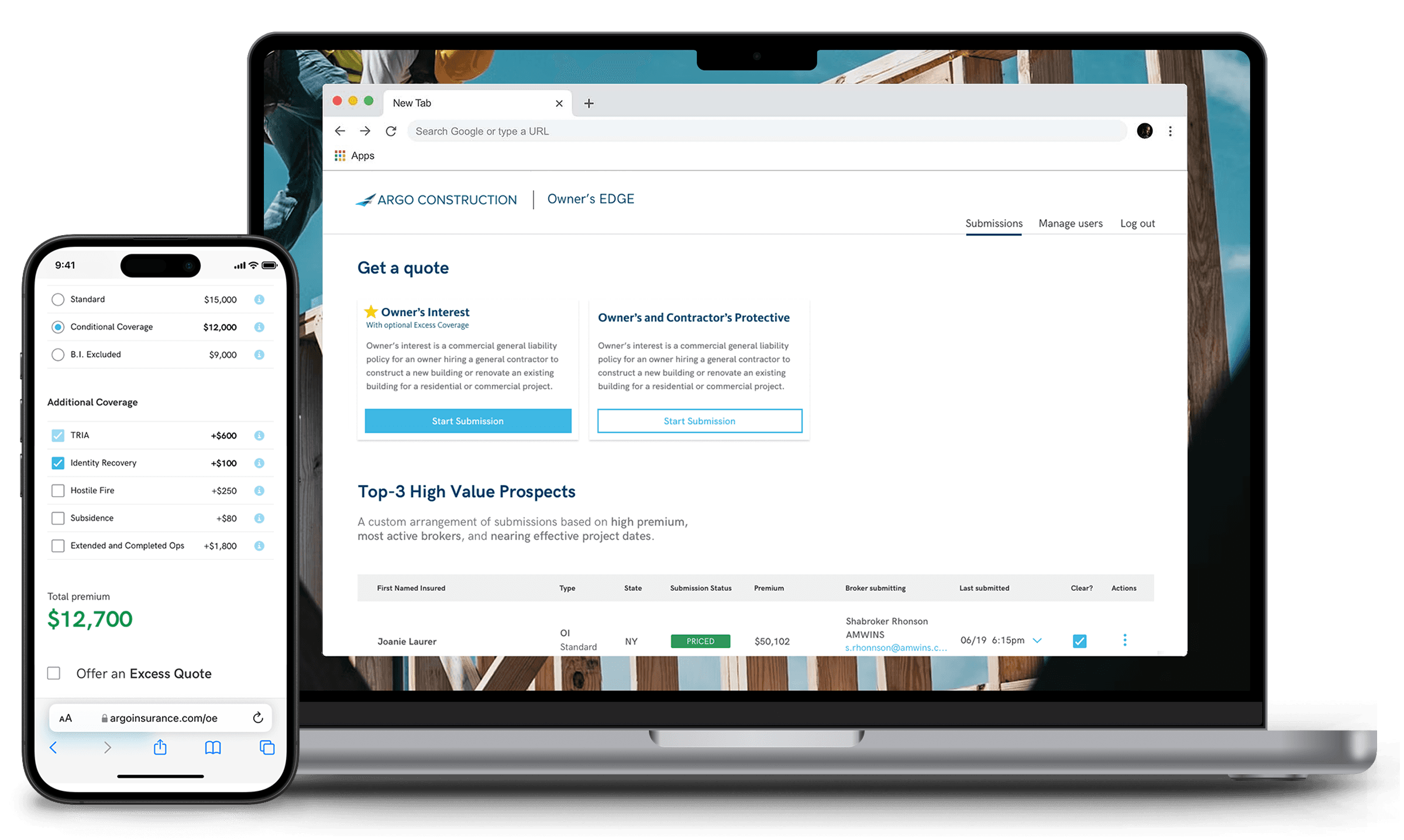

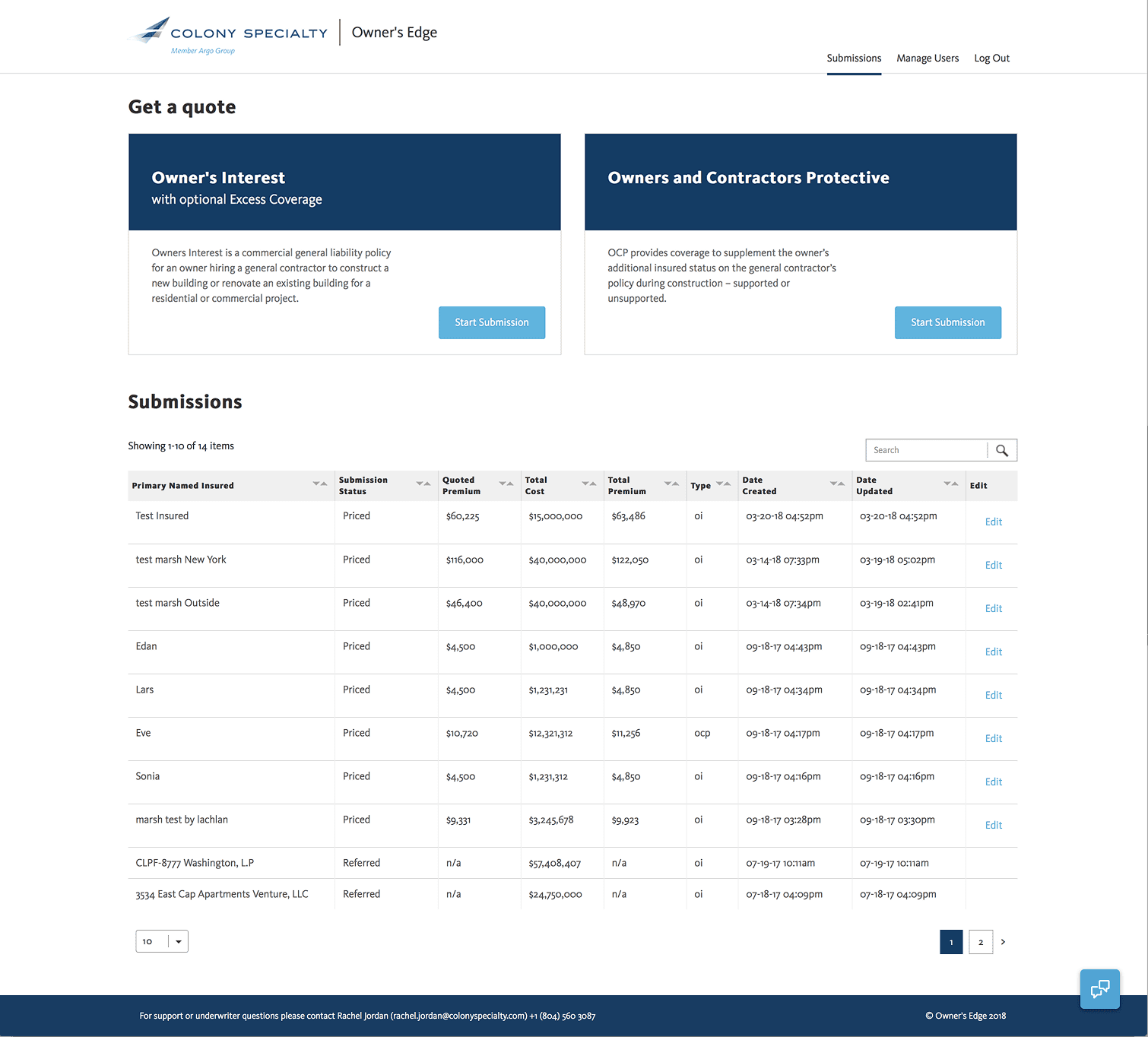

A web app where specialty insurance brokers generate quotes and prioritize valuable leads.

Summary

The ask

Argo, a specialty insurance provider (insuring towns, hospitals, construction projects, etc.) hired me as the sole designer on an agile product squad within their startup-style incubator, asking me to help them scale their MVP web-app, Owner's Edge, to the next stage, to capture more users and reach profitability.

My contributions

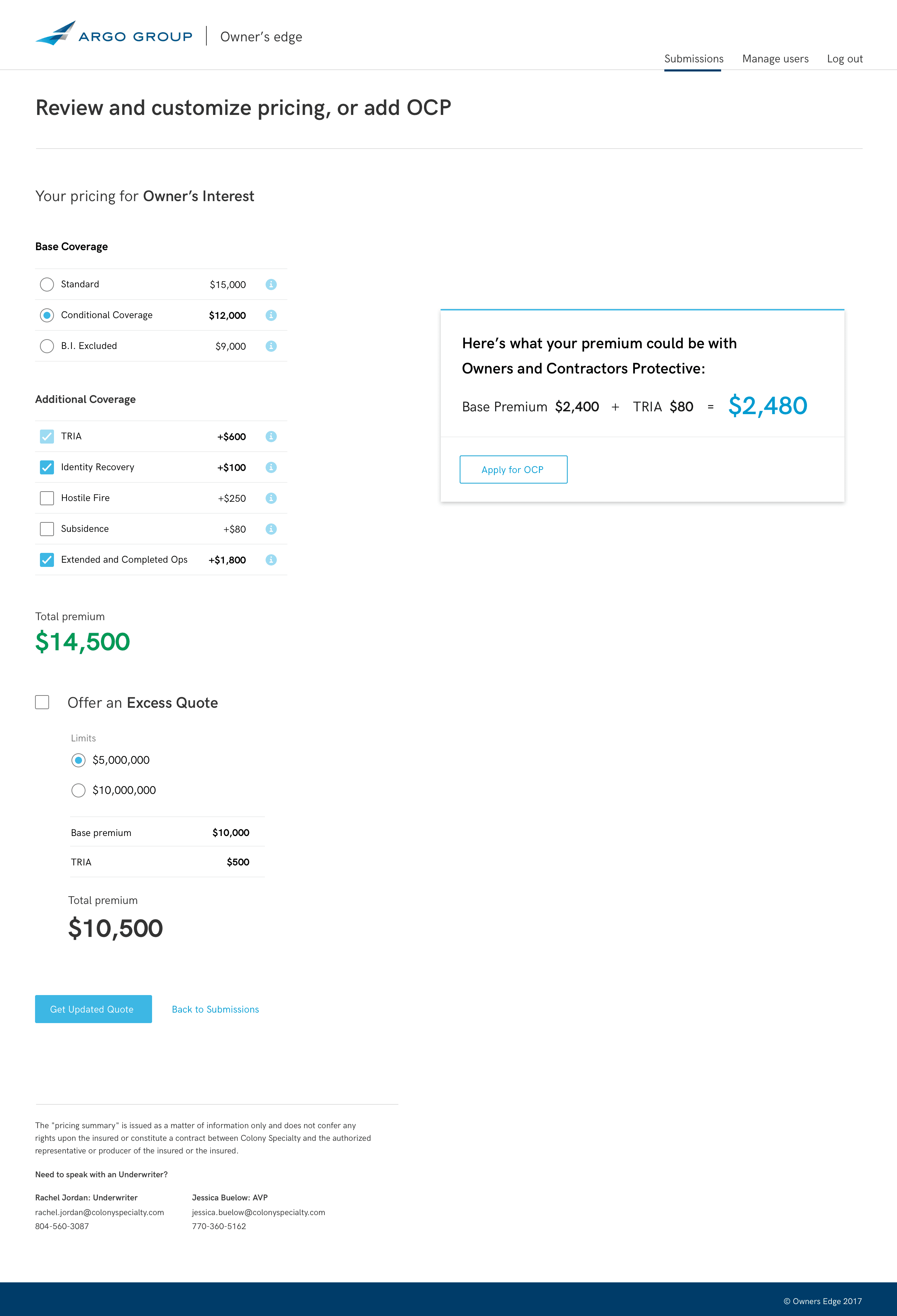

I ran user interviews & on-site broker visits, I facilitated squad workshops, and I designed 3 new features end-to-end—including in-app quote customization.

Post-launch, I scaled the solution to include quote versioning and AI-powered lead recommendations, while co-building the design system with designers from other squads.

Building the MVP

Business context

How do we reach profitability? 🤔

✱ Increasing the number of brokers closing business with Argo (+$1mil)

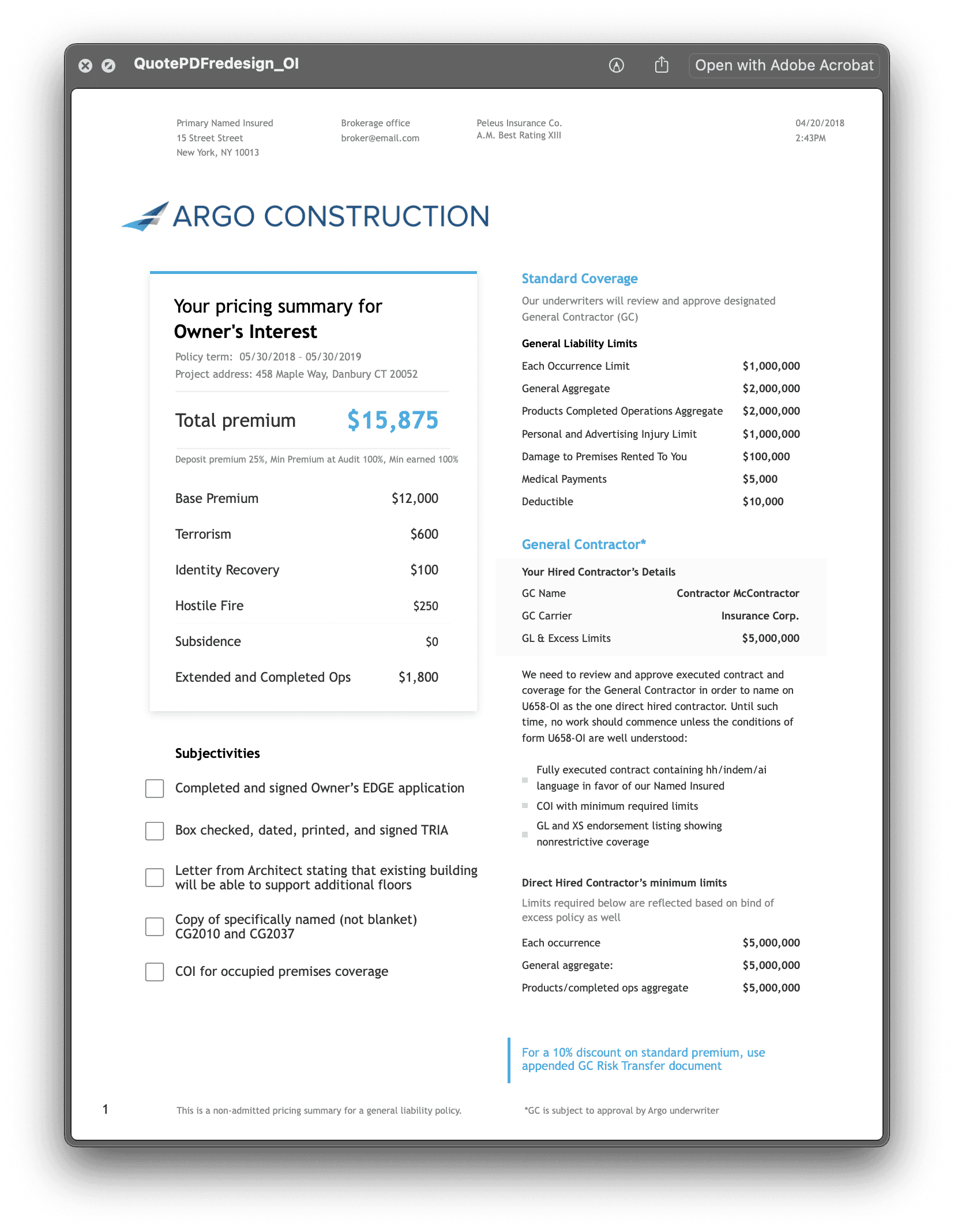

✱ Reducing the burn from underwriters manually customizing quotes (+$617K)

Together, this meant +$1.6mil to the topline.

User context

Understanding current users

The PM and I tag-teamed user research that included remote broker interviews & in-person contextual inquiries where we observed brokers at their place of work, noting habits, tools, software etc.

I learned that our current users were more established brokers who could afford to occasionally wait a few days for manual customization, or who closed enough deals on standard coverage that customization wasn't always critical.

Discovering potential new users

On the other hand, we found brokers who had chosen not to do business with Argo because we only offered standard quotes and with fast-moving clients who couldn't afford to wait, they chose more flexible competitors instead.

The sweet spot between both

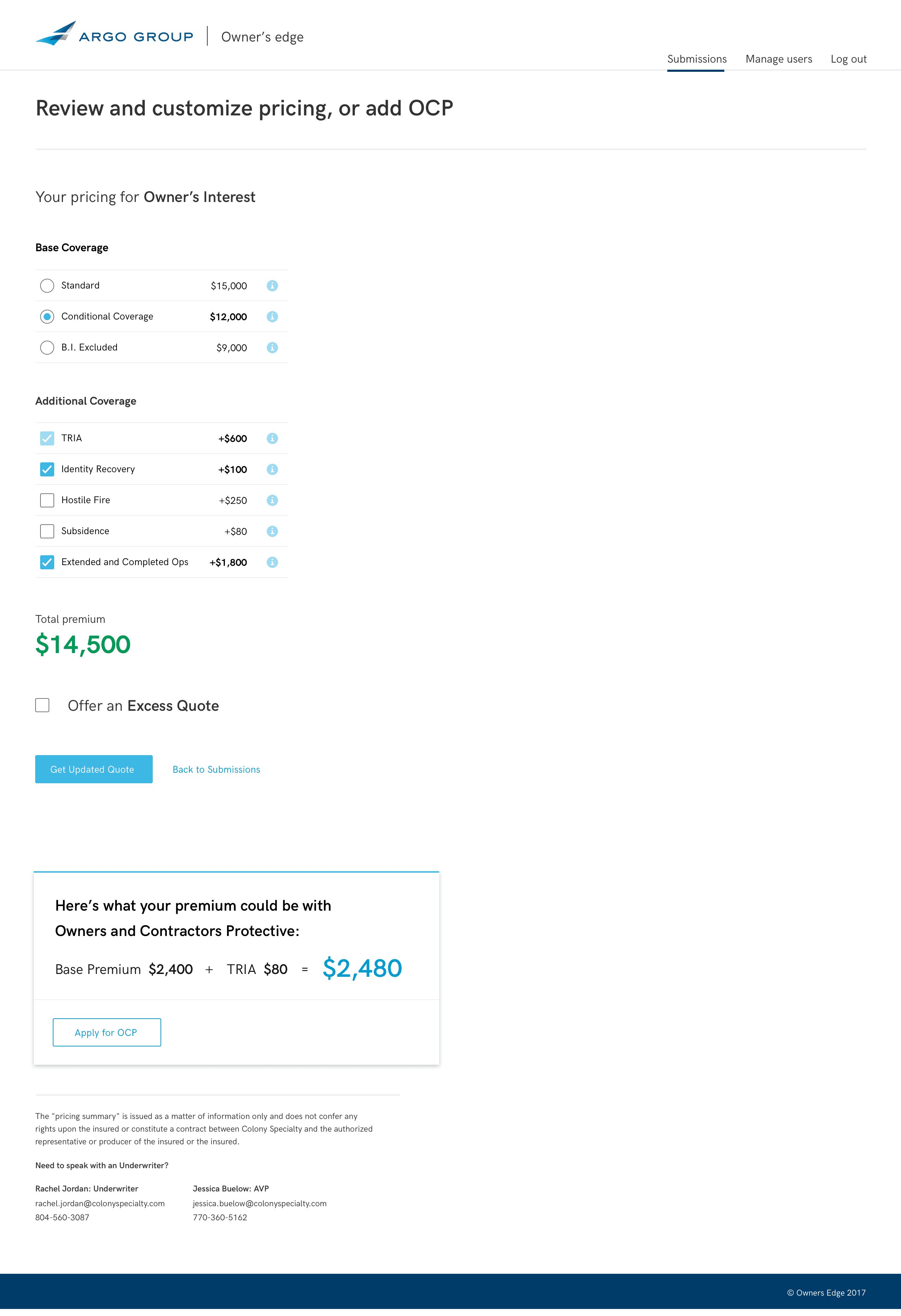

We identified a small set of customizations that both segments needed—addressing existing brokers' pain while targeting the barrier to entry for new brokers.

Design approach

Target product metrics

✱ Acquire >=25 new brokers / month

✱ Reduce % quotes called-in for manual customizations from 60% to 10%

Design requirements

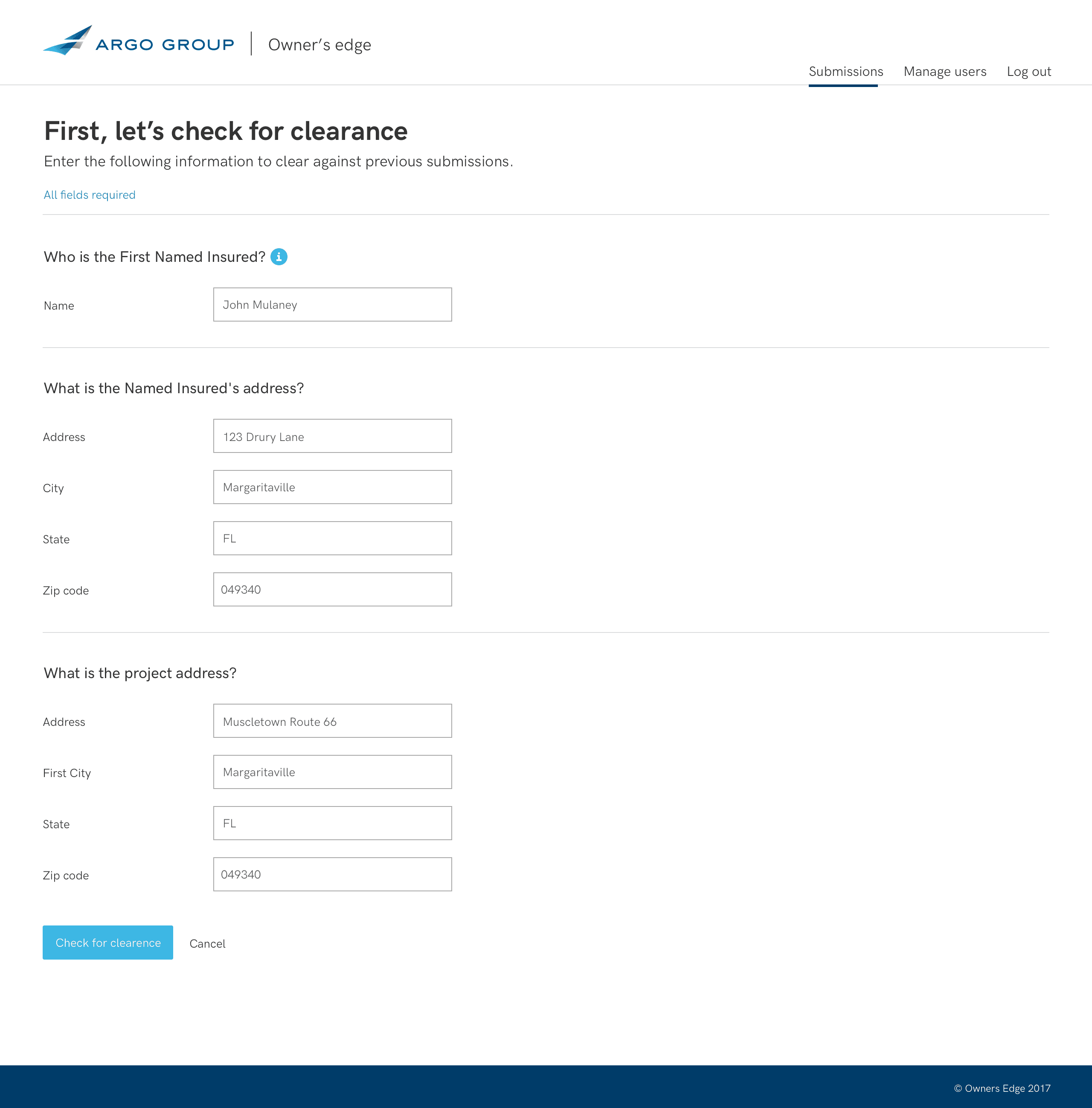

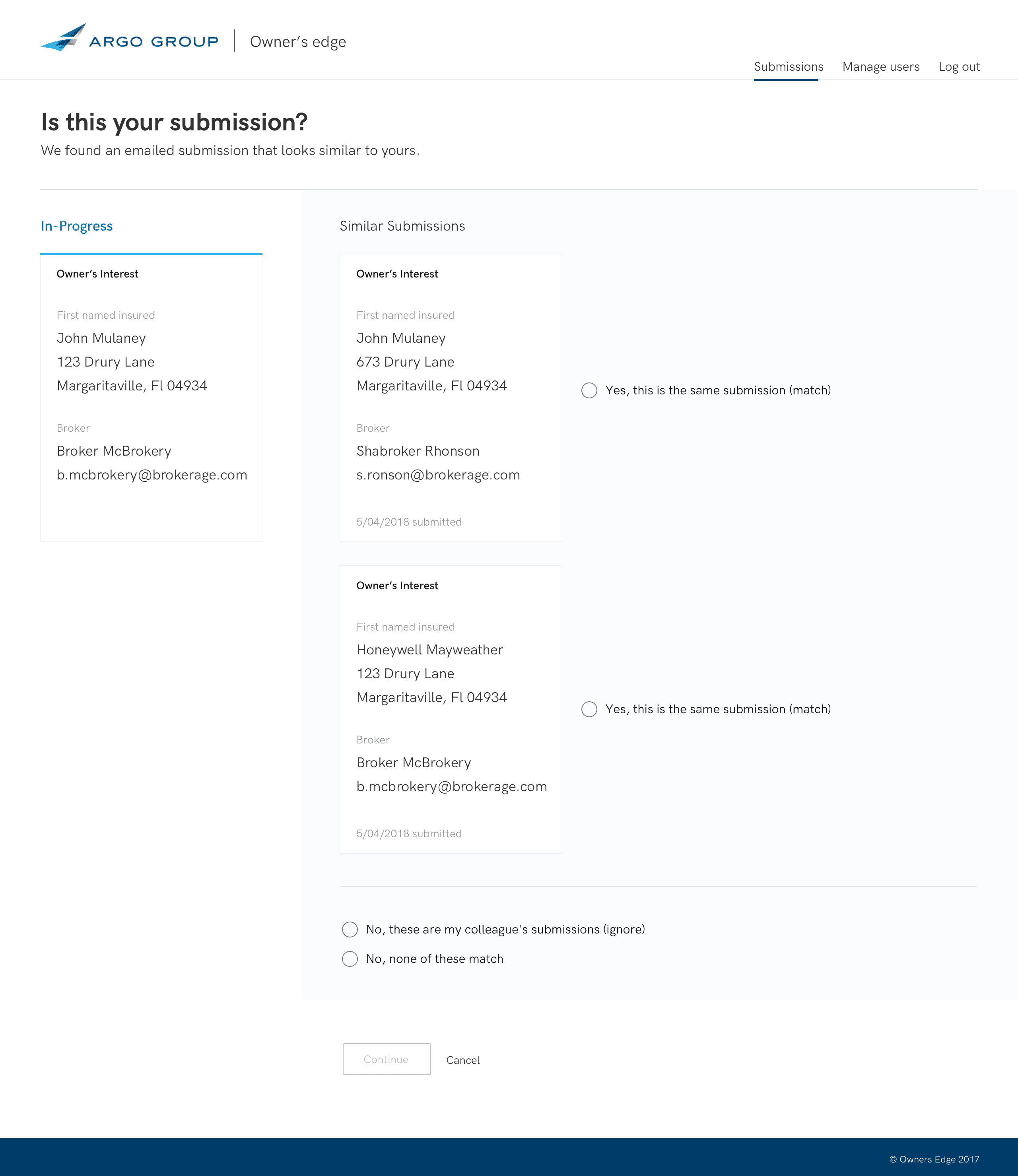

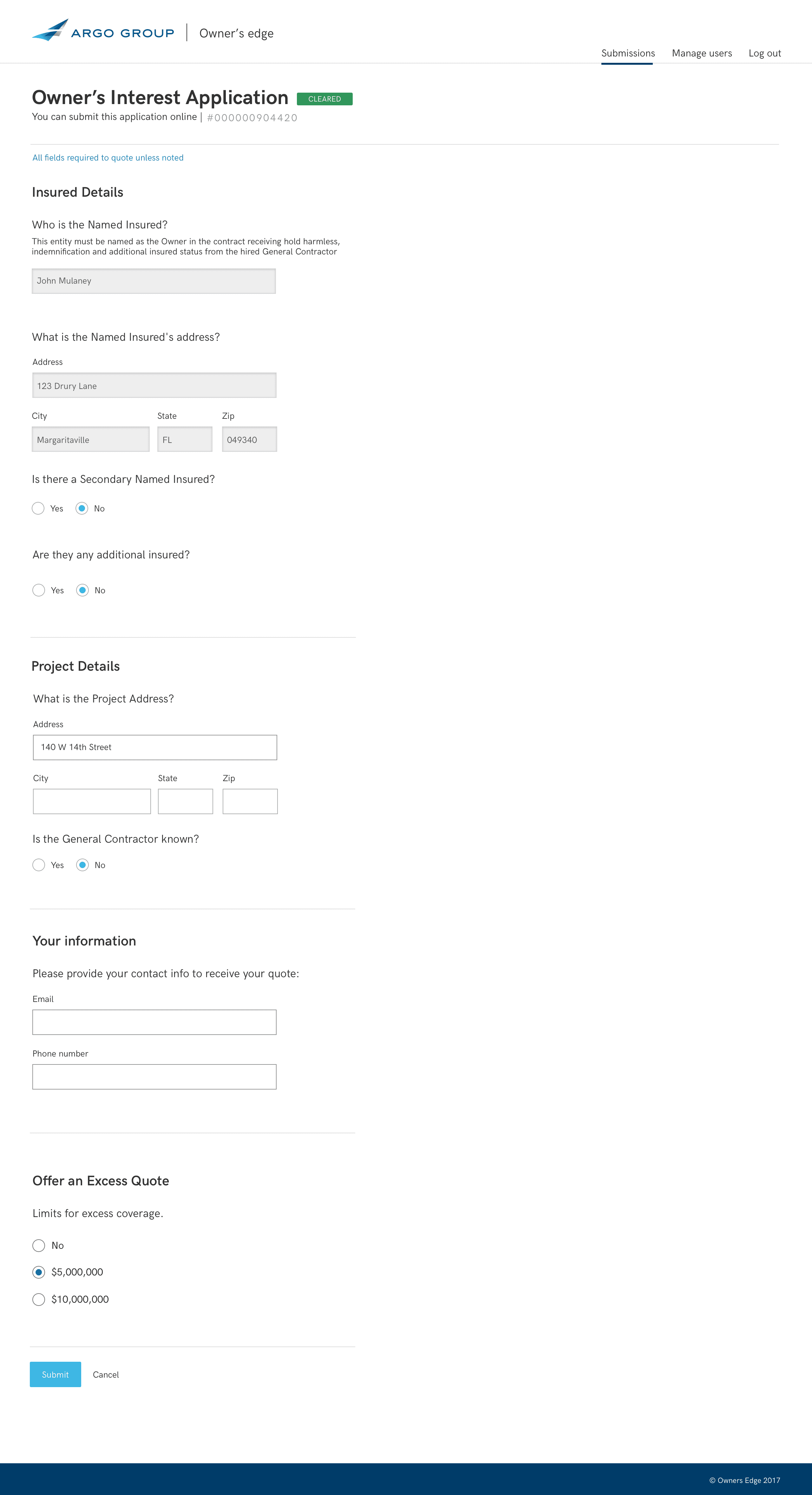

✱ Let users opt in / out of common coverages

✱ Help users quickly target leads likely to close

✱ Mirror users' simple MS-DOS inspired tools

✱ Minimize friction and prioritize speed

Designs

Post-launch

Outcomes

🎉 300+ new brokers onboarded

Over the 6-month release window—a longer window due to engineering constraints—strong word-of-mouth from the product's accuracy & a referral program drove 300+ new broker signups, 2x our original target of 24/month.

🎉 Reduced call-ins by 55%, 5% above target

Pre-redesign, 60% of quotes required underwriter calls to fix errors or add missing coverage. The new self-service customization flow dropped that to 5%, surpassing our 10% target and saving underwriters from hundreds of hours of rework each month.

🔻 An upsell add-on went down

Excess coverage—optional padding that increases policy limits—saw a drop from 20% to 11% of quotes after launch. I had inadvertently made it less discoverable in my design, hiding it by default.

Highlighted iteration

Outcomes, again

Post-launch feedback showed that brokers didn't always know they wanted to offer Excess without seeing it—kind of like travel insurance during check-out when buying a flight.

So I made it visible (but unchecked) by default. Discovery recovered to 18%, nearly matching pre-redesign levels without adding friction.